Feie Calculator - The Facts

Table of ContentsThe Facts About Feie Calculator Revealed9 Easy Facts About Feie Calculator ShownEverything about Feie CalculatorFeie Calculator Can Be Fun For EveryoneMore About Feie Calculator

Initially, he offered his U.S. home to develop his intent to live abroad completely and gotten a Mexican residency visa with his better half to help meet the Bona Fide Residency Examination. Furthermore, Neil secured a lasting building lease in Mexico, with strategies to ultimately acquire a building. "I presently have a six-month lease on a residence in Mexico that I can prolong an additional 6 months, with the purpose to acquire a home down there." Nonetheless, Neil points out that buying home abroad can be challenging without first experiencing the area."It's something that people need to be really attentive regarding," he states, and encourages deportees to be careful of typical blunders, such as overstaying in the United state

Neil is careful to mindful to Tension tax united state tax obligation "I'm not conducting any business in Company. The United state is one of the couple of nations that tax obligations its people no matter of where they live, suggesting that even if a deportee has no income from United state

tax return. "The Foreign Tax Credit score enables people functioning in high-tax countries like the UK to offset their United state tax obligation liability by the quantity they've currently paid in tax obligations abroad," states Lewis.

Excitement About Feie Calculator

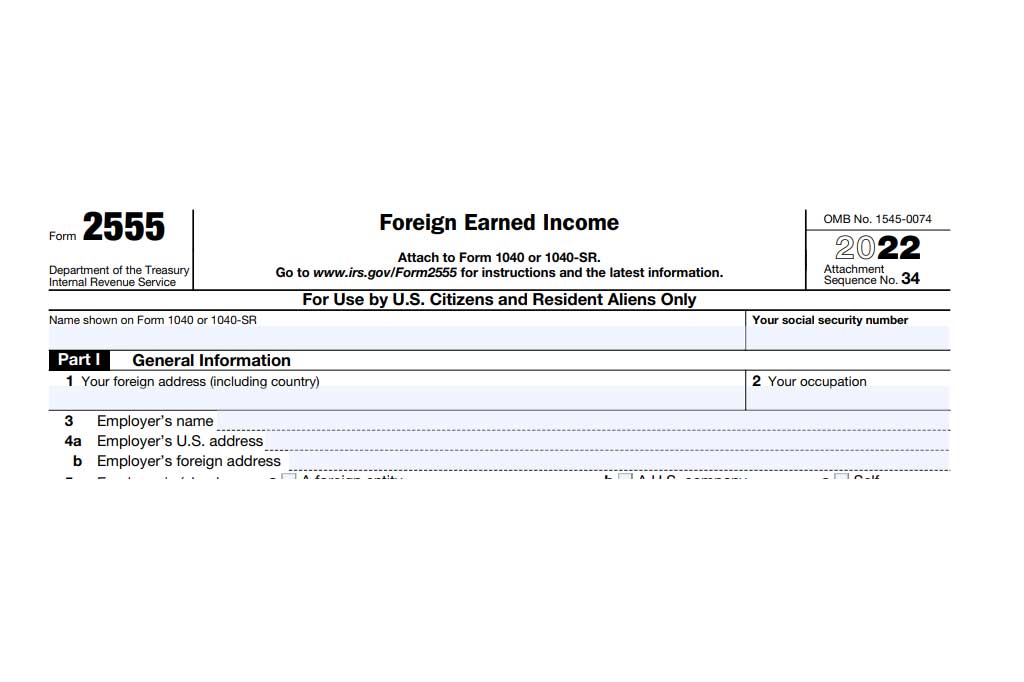

Below are a few of one of the most frequently asked inquiries concerning the FEIE and other exclusions The Foreign Earned Earnings Exclusion (FEIE) allows U.S. taxpayers to exclude up to $130,000 of foreign-earned earnings from government earnings tax obligation, decreasing their U.S. tax obligation responsibility. To receive FEIE, you have to meet either the Physical Existence Test (330 days abroad) or the Bona Fide House Test (verify your key residence in a foreign country for a whole tax year).

The Physical Existence Test additionally requires United state taxpayers to have both a foreign revenue and a foreign tax home.

5 Easy Facts About Feie Calculator Shown

An income tax obligation treaty in between the U.S. and an additional nation can aid avoid dual taxation. While the Foreign Earned Revenue Exclusion decreases taxable revenue, a treaty may offer fringe benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for filing for united state people with over $10,000 in international economic accounts.

Eligibility for FEIE depends on meeting certain residency or physical presence tests. He has over thirty years of experience and now specializes in CFO services, equity compensation, copyright taxation, marijuana taxation and divorce relevant tax/financial preparation matters. He is an expat based in Mexico.

The foreign earned income exemptions, sometimes referred to as the Sec. 911 exclusions, exclude tax on salaries gained from functioning abroad.

Feie Calculator - An Overview

The earnings exclusion is now indexed for rising cost of living. The optimal yearly income exemption is $130,000 for 2025. The tax obligation advantage omits the earnings from tax at lower tax rates. Previously, the exemptions "came off the top" lowering income topic to tax on top tax prices. The exclusions may or might not lower earnings utilized for other functions, such as IRA limits, youngster credit scores, individual exceptions, etc.

These exemptions do not excuse the incomes from United States taxes however merely offer a tax decrease. Keep in mind that a single individual working abroad for every one of 2025 who made regarding $145,000 without various other earnings will have taxable article source earnings lowered to absolutely no - effectively the same solution as being "free of tax." The exemptions are calculated daily.